International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 1

ISSN 2229-5518

An Electronic Payment Model for Small and

Medium Enterprises in Zimbabwe

Tatenda D Kavu, Taurayi Rupere, Benny M Nyambo, Gilford T Hapanyengwi

Abstract—Electronic payment systems are proliferating in banking, retail in government and everywhere money needs to be exchanged. Electronic payment systems are the everyday technology under use, they are the relevant systems which go hand in hand with technology and they are also high in demand. All these issues enlighten a need to design and implement an electronic payment system that addresses the specific requirements for the Zimbabwean market. An effective and universal electronic payment system in Zimbabwe can solve some problems which are currently encountered in e- commerce, thus we designed a light weight electronic payment model, universal and offering better integration to banks, all merchants and Small and Medium Enterprises. It is comprised of attributes which any electronic payment system is expected to have. It has its own security features especially the offline authentication method and other security aspects which are currently in use by banks. The integrated architectural view of the model makes it a possible solution to some current problems. This model creates a pathway for an ideal full implementation of an electronic payment system. We com- pared our model with the existing electronic payment systems in Zimbabwe. We realized that our model compares fairly with the existing models.

Index Terms—Small and Medium Enterprises, Business to Consumer ecommerce, Secure Socket layer protocol, Transport Layer Security protocol, Universal Electronic Payment System

1 INTRODUCTION

—————————— • ——————————

nformation and Communication Technologies (ICTs) have been adopted widely around the world in recent times. In Zimbabwe, the same trend can be observed par- ticularly in mobile wireless systems. These developments have been more pronounced in the last decade. Electronic Payment Systems (EPS) have increasingly become a mode of transacting globally. EPS need to strike a good balance between a number of different issues such as; anonymity (which is the extent to which a third party or the merchant has information about the identity of the buyer) and ato- micity (which means the system should be fair and robust in the sense that network failures, for example, do not re- sult in incomplete transactions) [1]. All these issues point to a need to design and implement an electronic payment sys- tem that would address the specific requirements of the Zimbabwean market as the system has to be unique to the networking conditions and the financial regulations within

the country.

Consumers across the world are increasingly using online business. That is large transactions are being carried out through wireless and wired data transmission networks, with the help of mobile devices and mobile databases so that the distance to a shop is just a click of a button. Gener- ally this is regarded as a little bit advantageous though some inconveniences can happen especially on the delivery side. In Zimbabwe this kind of handling business is still behind, it is an unfulfilled dream. Worldwide the amount of business done online has grown extraordinarily resulting from the widespread of internet usage and also the de-

crease of the cost of using it. Bandwidth costs have gone

down and internet usage has also improved in Zimbabwe due to the introduction of technologies like CDMA (Code Division Multiple Access) supporting 3G for mobile tele- communications in companies like ECONET wireless Zim- babwe, NetOne, TELECEL Zimbabwe, Africom, Powertel, Broadcom, and Utande. With all this in industry, B2C mod- el should become an easier way of making payments na- tionwide. The business which is familiar to many internet users worldwide is that of selling virtual products which are mainly games, music, videos or software.

Integrating payment systems developed in different parts

of the world with local SMEs is a challenge due to lack of ICT knowledge and limited bargaining power with inter- mediaries [2]. In Zimbabwe there is eTranzact (which is the first online real-time payment system in Zimbabwe that allows individuals and corporate account holders to pay for goods and services purchased from merchants), Electra Card Services (which has same attributes as eTranzact). Clients for these two have to be customers of specific banks namely Kingdom Bank and First Bank Corporation respec- tively.

A lot of instruments have been developed and most of them are under use in Zimbabwe such as eco-cash, electronic cheques, debit cards and credit cards. Most of these have their own advantages and disadvantages with credit cards working a little bit better than others. Online credit card and debit card payment system has been widely accepted by consumers and merchants throughout the world and are

by far the most popular methods of payments especially in

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 2

ISSN 2229-5518

the retail markets [15]. This type of a payment system has many advantages over the traditional modes of payment. Some of the most important are privacy, integrity, compati- bility, good transaction efficiency, acceptability, conveni- ence, mobility, and low financial risk [15]. So for this re- search credit cards and debit cards were used as the pay- ment instruments due to the above reasons.

The paper aims to offer integration solutions to the mer-

chants with the banks, the payment model is coming as an intermediary (as the gateway) for making payments online, ultimately the integration will not temper around with the security systems of both the banks and the merchants. The paper analyses the current payment methods used by the local merchants, consumers and banking sector. It also in- vestigates the current standards and procedures imple- mented by electronic payment providers and finally it comes up with a model for a universal and standard pay- ment system which is suitable in Zimbabwe. The model has aim to work with any financial institution and merchants especially SMEs.

2 LITERATURE REVIEW

2.1 Introduction

Payment system is sometimes used as a synonym for Inter- bank/Intra-bank Funds Transfer System (IFTS). However at a general level the term “payment system” refers to the com- plete set of instruments, intermediaries, rules which bind the

transactions, procedures, processes and interbank funds transfer

systems which facilitate the circulation of money in a country or currency in an area [8]. In this case a payment system com- prises three main elements or processes which are instru- ments, processing and settlement. Payment systems are

classified into four categories which are online credit card payment system, online electronic cash system, electronic cheques and smart cards based electronic payment systems [8].

2.2 Present e-Payments

At present e-payments are competitive for purchases of mobile content and items like vending and ticketing, but the traditional payment services still dominate the volume sales. This ensures future research should study the devel- opment trends of different payment services and identify opportunities for e-payments [10]. More research is thus needed to come up with new payment strategies in the fu- ture and also to come up with new ways of integrating tra- ditional and new payment services if it is necessary to form a seamless overall financial infrastructure for customers [10].We see service providers such as PayPal, Amazon and

Google acquiring a role in online payments and traditional banking services [14]. PayPal has opened a door to further research on integration by developing Application Pro- gramming Interface (API’s). (United Nations Economic Commission for Africa, 2010) concludes that most African national payment systems are weak in technical infrastruc- ture which infers that they are weak in terms of anonymity and atomicity. Bringing the idea that there is a need to im- plement secure domestic system/network and addressing operations [16].

2.3 Existing E-payment models

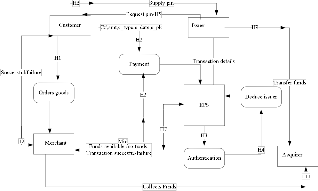

Figure 1: Generic Model of a Payment System [1]

Most E-payment models are derived from the generic mod- el which has basic features of an e-payment model, with additional features which would be found relevant.

There is a lot of existing e-payment models. In this research we are mainly looking at the one working model of e- payments which uses credit cards for transactions between customers, merchants and banks. To test and evaluate the payment system, an online travel agency called E-Travel which simulates a real-life E-Payment application was de- veloped. The procedure of buying goods in the payment system is the same as that in a real life situation. The main focus was on the purchasing part (how customers interact with merchants) and the payment process (how money is settled). A light-weight payment system for E-Payment ap- plications was then developed [13].

There is a model called Person-to-Person (P2P) payment system. The model offers a portable e-wallet that is in- stalled in a removable storage (e.g. flash memory). Also the

model provides a secure and portable payment system

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 3

ISSN 2229-5518

which can be conducted by users in P2P transaction. This model can also be used to make micropayments by B2C and C2B. The P2P model focuses on: the usage of remova- ble Storage flash memory as client based e-wallet to hold the e-cash [4].

A model of an EPS usually involves a payer (customer) and a payee (merchant, in this case SMEs which were taken much into consideration). It also involves exchanging money for goods or services, and one or two financial institutions acting as an issuer on behalf of the payer or an acquirer on behalf of the payee. In this paper these are referred to as major players in an EPS. A typical payment system therefore interconnects the payer and the payee and is usually initiated by an instruction from the payer using an agreed instrument through the issuer and acquirer in computer networks which enables them to exchange money [3]. Essential information was collected from these four parties for the payment model to be acceptable and usable since these are the parties which will use the system.

To proceed to the design of the model, the following information was needed from the participants:

Banks (Acquirer/Issuer): when the issuer debits a certain credit/debit card account by a certain amount, the acquirer must possess an unforgettable proof that the owner of this credit card has authorized the transaction. Therefore bank(s) must have a secure connection for bank transfers and authentication this is a prerequisite for the success of the EPS model. The bank(s) should have a payment instrument which is secure and efficient. Authentication should be thorough to reduce forgery from insiders and intruders.

Merchants (sellers): Merchants have an important role in the development of payment services. They create the market for financial institutions and other payment service providers. Some payment solution failures were explained by the lack of merchant involvement in the development and deployment[10]. Their active participation provides an important vote of acceptance. The seller must finally have a stored proof for an order of payment authorized by a customer with a certain id so that the merchant cannot access customer ’s bank details. Again the seller must not have the access of the credit/debit card number of the buyer and must have a way of coming to a point where the payment process is declared complete and the customer is in a stage of collecting the goods or services all being processed online.

Buyers (Online customers): Without the credit/debit card

number associated with a registered card issuer no transaction must be done. Buyers must be in a position to do their transactions without fear of incomplete transactions or failure of connections and they choose how they want to be notified during and on completion of transactions.

2.4 Limitations of Present e-Payment Systems and

Working Models

There are payment instruments in Zimbabwe such as e- wallet from NETONE and eco-cash from Econet Wireless Zimbabwe. These are not yet used in online shopping processes and they do not have the capacity to produce the data that merchants would like to feed into their legacy back-office systems. Solving these problems would help to increase the efficiency of electronic payment systems [2].

Limited adoption of ICT in SMEs is partly due to the lack of dynamism between ICT firms and SMEs. It is found that many people are still using the old way of making pay- ments; the popular method of payment which is physical cash payments [6]. When ICT firms provide goods and ser- vices in the past for the market it was not necessarily tai- lored to SMEs because of low demand from SMEs and this was because of lack of expertise in SMEs [7]. ICT firms used to target large enterprises because they had a larger budget and were willing to pay for more complex ICT services. However competition in this market is making firms both large and small turn their attention towards the untapped SME market [9]. At the same time the propensity to partici- pate in e-commerce and the requirements to enter into the chain of online payments with both corporate and house- hold clients are continuously pushing SMEs to adopt the culture of online payments. The majority of SMEs are still lagging behind in using accounting functions and internet as well, mainly in their core element of business and a channel to expand their businesses [7].

Various surveys related to SMEs e-preparedness in devel- oping countries suggest that only less than one quarter of SMEs having the web presence do actually use it as a busi- ness instrument i.e. undertaking active Web trading and related e-payments operations. The majority of SMEs still limit their activities by maintaining a web page with vari- ous levels of links and advertising. On Internet they also gather information on markets and competitors as well as searching for partners with further negotiations taking place either through emails or offline while the successful deals are generally completed in a traditional manner [5].The prevailing situation for worldwide SMEs is the situ-

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 4

ISSN 2229-5518

ation for large enterprises in Zimbabwe. Thus an e- payment system that integrate with these e-commerce sites will be of significance.

3 METHODOLOGY

A mixed research approach was used with an emphasis of qualitative approach because of its array of interpretative techniques which seek to describe, decode, translate and otherwise come to terms with the meaning, not the fre- quency of naturally occurring phenomena in the social world [3] .The aim was to understand the way banks oper- ate, and how best we can integrate merchants’ ecommerce platforms with the new model of the EPS. To maintain the qualitative research approach we used semi-structured in- terviews for merchants and banks then questionnaires to buyers. The main reason of doing this was for us to find comprehensive information with deep meaning especially from banks and merchants as also the legal aspect of the infrastructure was to be addressed from the bank’s perspec- tives. A thematic approach was used to analyze the data recorded from interviews and was transcribed to retain the needed information.

The EPS model was designed from data mining, survey, case study and design science. From the data mining we got features which were adapted from the generic model and other models in literature. To Design a user centered EPS model, a lot of things were taken into consideration. We looked at who were the major participants in the EPS and how each of these participants contributes to the design of the model. Vital information was taken only from major contributors considering what they want to be included on the EPS.

We approached banks that had their own e-payments sys- tems and they explained the extent of the integration be- tween their systems and the merchant’s e-commerce plat- forms. The start-up process for in-house transfers and ex- ternal (that is paying a merchant with another bank’s ac- count) transfers were explained so that it would be incorpo- rated in the model. We also took suggestions from the ex- perts concerning the introduction of a universal e-payment system. Experts in the banks’ e-commerce departments gave us their ideas about features and functionalities which a universal e-payment system would incorporate and con- sists of. We also took note of the Zimbabwean business model, and derive that the business model would need an e-payment system which fits into it without anomalies. We

considered semi-structured interviews as the best method

to collect this information from banks which would be part of the major design and implementation of the model.

For merchants who were already using an e-payment sys- tem, we considered their integration with the proposed e- payment system so that some features would be adopted which were already familiar to the users. Conflicts on the instruments to use between merchants and banks were eliminated at all cost. Authentication was considered on both the merchant’s side and the bank’s side. Therefore, questions were given to the merchants to clarify on their interest in the involvement of the third party; otherwise real authentication would be carried by the issuer and the ac- quirer. Merchants also chose how they wanted to be noti- fied. Regarding the importance of merchants, semi- structured interviews were used to collect the important information. Some information was collected using ques- tionnaires asking what kind of payment instruments buyers were familiar with which they will easily use online with- out any need for training. Buyers were also given an option to propose the means of communication between them and the system.

The population consisted of all 23 banks in Zimbabwe, all merchants in Harare and 200 people who can do transac- tions online. Looking at the sample we considered 5 banks in Harare. These banks gave a representative sample of the Zimbabwean banking sector; i.e., Very innovative, indigen- ous, market share, international, and customer diversity. We also discovered that these banks are also working with mobile network providers to provide users with mobile banking and other ways of payments. 25 merchants were approached to give information and among these mer- chants 18 were SMEs; we considered mostly young busi- nesses in Harare small shops, butcheries, shops selling elec- tronic gadgets, clothes. We also got some information from big enterprises like Spar which are found nationwide, Bar- bour ’s (one of the big shops selling clothes) and TV sales these are some of the big enterprises in Zimbabwe. 45 questionnaires for buyers were distributed to the University of Zimbabwe students. This sample was assumed effective on gathering required data especially on buyers because a lot of students have the knowledge of using internet and has much access to it freely.

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 5

ISSN 2229-5518

4 RESULTS AND DISCUSSION

From the data collected from semi –structured interviews and questionnaires we found that in banks, there are some that are at the fore-front in terms of improving their elec- tronic payment systems. These are also coming up with their own ideas and implementations to make real pay- ments online. In general, banks have really improved their e-business by introducing e-banking, SMS banking, EFT- POS (Electronic Funds Transfer Point of Sale) and other technologies by integrating with mobile network providers.

All the five banks are using Credit cards, Debit cards, mo- bile devices, internet banking as their main instruments in banking. We thus deduced that other banks which we did not approach are also using these instruments for banking since the center for inter-bank transfers is controlled by the Reserve Bank of Zimbabwe (RBZ). Some banks are using international cards like Master card and Visa card. Some of the features in our model were adopted from those banks. We were much interested with Cell card services offered by one of the approached banks, it works in such a way that, when their client wants to purchase goods or services from a merchant who has a merchant id registered on the Cell card service, the client supplies his/her pin code using the mobile phone then a secret code is sent back to the client then he uses that secret code to authorize a transaction to be done transferring money into the merchant’s account. The cell card services works perfectly with the one of the mobile networks. The mobile number is associated with the client’s bank account. Debit cards are the ones which are mainly used on POS during purchases if the merchant has already installed it. There is no real integration with merchant’s e- commerce platforms for the moment, which makes this model new in the e-commerce world in Zimbabwe. E- Transact is mainly used in Bill payments, airtime top-ups and by few merchants in Zimbabwe.

We also realized that 80% of the merchants approached are advertising their products online, but there is no real pay- ments conducted online at the moment. Merchants in large businesses such as supermarkets and those selling electron- ic gadgets use POS and other ways of payments for their transactions. From the buyers’ point of view, 91.1% of the 45 potential buyers say credit cards and debit cards are the easiest to use on websites since the credit card number is only used for transactions to take place. 95.6 % of the buy- ers favor SMS communication with the system rather than to use emails.

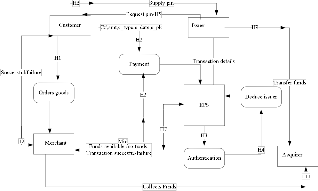

4.1 The UEPS model

The model came up from the data gathered and also from the generic model in chapter two. We go on and design the artifact of the model using PHP, MYSQL server, apache, Ozeking SMS gateway and Server working with a modem from one of the mobile network providers. Testing was done using an e-commerce platform we designed called Global Market Place. Only the merchant id, total amount, secret and public keys were sent as hidden variables to the UEPS. Virtual banks were used for testing, LAN was used as the testing environment, one computer was set up as the server, and 25 computers were set as client machines. Dif- ferent servers with different RAM sizes were used, that is,

512Mb, 1Gb, 2Gb. Concurrent requests were executed the

time taken to receive SMS was 2 sec, the whole process took an average of 44 seconds and the worst case was 57 seconds. The checkout time was 1.08 seconds and 7 execu- tions were done to come up with an average time. We rea- lized that, as the number of requests increased, the check- out time increased also, but it was compensated by the in- crease of RAM size on early stage.

System Functionality and Specifications:

From the artifact we came up with the functionalities of the model which are:

• H1: Customer/client after finishing choosing the product from the merchant’s homepage using a client browser which has a secure connection using SSL proto- col for information transferring makes a purchase from

a merchant server by clicking on a payment (button).

• H2: When the EPS receives the message from the merchant the EPS uses the corresponding keys to de- crypt the message (H3). The EPS will deduce the issuer (H4) from the credit card number and it will communi- cate with the issuer through an existing banking net- work.

• EPS encrypts the message and sends it to the issuer

• The issuer decrypts the message and processes it

• H5: The issuer sends an SMS and email to the cus- tomer asking for a pin code associated with the credit card number as a way of improving security.

• H6: The customer reply with the pin code then the

issuer will communicate with the EPS and the issuer will continue processing the transaction.

• H7: The EPS will compose a message to the mer- chant for record purposes.

• H8: Upon the receipt of the EPS’s message the mer-

chant will compose a message to inform the custom- er whether the purchase is successful the message will be displayed as an HTML document for the cus-

tomer.

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 6

ISSN 2229-5518

• Issuer debits the client’s account and sends an SMS/email, acknowledging that a transaction has happened and there is a new balance in the account

• H9 : Issuer transfer the amount to the acquirer

• Acquirer credits the merchant’s account.

• After a confirmation message is sent to the cus- tomer the payment process is said to be complete.

• H10: The merchant can check balance and with- draw funds.

Keywords from the UEPS Model

Payment:

• Amt: total amount of the purchased goods

• C# :credit card number of the customer

• C_type :either MasterCard(MC) and VISA(VS)

• C.PK: the digital signature of the message , it uses the client’s private key

• M.id : the merchant’s ID given by the EPS for unique identification of each merchant

• Hi: Sequential order of process where i is a varia- ble.

In coming up with the model, the following assumptions

Attributes under test | UEPS | eTranzact | BALASORE (model) |

Anonymity |

| limited |

|

Applicabil- ity |

| limited | Limited |

Level of integration |

| much limited |

|

Traceability | |

|

|

Security | | | insecure |

Portability | limited | | limited |

Atomicity | limited |

|

|

Cost effec- tiveness |

| limited |

|

Mobility |

|

|

|

were made:

• The buyer has already an account with the bank re- fereed here as the issuer

• The credit card is issued by the bank or issuer

• The merchant has an account already at the acquir- er

• The response of the bank to the buyer for the new

balance is outside the model

• All the processes on the diagram are the ones which are visible on the model.

Figure2: The UEPS (Universal Electronic Payment System)

model

5 DISCUSION AND CONCLUSION

The model was evaluated based on the following: anonymi- ty, traceability, security, portability, atomicity, cost effective- ness, standardization and universality (range of applicabili- ty) and level of integration. It was compared with the mod- el designed at Balasore and with eTranzact. We find that eTranzact is the e-payment system which has some features which are similar to our e-payment model, for this cause it was used in the comparison.

After some comparisons we discovered that this model will create a road to design a light weight e-payment system offering better integration to all merchants as well as SMEs in Zimbabwe. For further work new security aspects on the e-payment model need to be addressed to cope up with the ever-changing technology and also to incorporate other payment instruments on the e-payment model.

Table 1: Comparing the attributes of our model to eTranzact and Balasore models

6 REFERENCES

[1] Bellare, M and Jutlaz, C. Variety Cash: a Multi- purpose Electronic Payment System. In M. Yungx

(Ed.), Appears in Proceedings of the 3rd Usenix

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 7

ISSN 2229-5518

Workshop on Electronic Commerce, 1998. (p. 3). California: IBM T.J. Watson Research Center.

[2] Bohle, Knud.,”Integration of Electonic Payment Systems into B2C internet Commerce,Problems and perspectives”. Electronic Payment Systems Observatory, 8, 1-3, April 2002.

[3] Brooks Laurence and Austin Briggs.”Electronic

Payments Systems Development in a Developing Country:The Role of institutional Arrangements,” The Electronic Journal of Information Sytems in Developing Countries, vol.49,no(3),pp 7-8,2011.

[4] Hattab Ezz and Fadi Abulhamid,” A model for

Person-to-Person Electronic Payment. Retrieved may

31, 2012, from Citeseerx:

http://citeseerx.ist.psu.edu/viewdoc/summary?doi

[5] Indjikian, R. (2003). E-finance for SMEs:global trends and national experiences. In R. Indjikian (Ed.), NEW TECHNOLOGIES FOR SMALL AND MEDIUM-SIZE ENTERPRISE FINANCE THE

WORLD BANK CONFERENCE, 4-6 DECEMBER,

WASHINGTON (pp. 4,26,33). Washington: UNCTAD.

[6] J Raja, M. S. (2008). E-payments: Problems and

Prospects. Journal of Internet Banking and Commerce,

13(1), 12.

[7] Jayamalathi Jayabalan, M. D. (2009). Outsourcing

of Accounting Functions amongst SME Companies in Malaysia: An Exploratory Study. Accountancy Business and the Public Interest, 8(2), 97.

[8] Kokkola, T. (2010). Payments Securities , Derivatives and the role of the Euro system:The Payment system (1st ed.). (M. Hart, Ed.) Frankfurt am Main:

European Central Bank.

[9] Kotelnikov, V. (2007). Small and medium enterprises and ICT. Asia-Pacific Development Information Programme e-Primers for the Information Economy,Society and Polity, 10-12.

[10] Mallat, T. D. (2006). Mobile Payment Market and

Research-Past, Present and Future. ECIS, 6-10. [11] Mihir Bellare, J. A. (1998). Implementation and

Deployment of a Secure Account-Based Electronic

Payment System. 4,6-7.

[12] Mihir Bellare, J. A. (1999, june 26). Design, Implementation and Deployment of a Secure Account- Based Electronic Payment System. Retrieved april 10,

2012, from citeseerx:

http://citeseerx.ist.psu.edu/viewdoc/summary?doi=

10.1.1.55.3790

[13] Partha Pratim Ghosh, A. K. (2010). The working model of an E-payment system. Journal of Theoretical and Applied Information Technology, 13(1),

10-12.

[14] Remco Boer, C. h. (2010). Online Payments. Innopay

BV, 60-63,67,69.

[15] Singh, S. (2009). Emergence of Payment Systems in the age of Electronic Commerce: The State of art. Global journal of International Business Research, 2(2),

17,19,22.

[16] United Nations Economic Commission for Africa. (2010). Assessing Regional Integration in Africa IV: Enhancing Intra-African Trade by the Economic Commission for Africa (iv ed.). (U. AfDB, Ed.) Addis Ababa: Economic Commission for Africa.

Table 2: Performance comparison of our model to eTranzact and Balasore model

| UEPS | eTranzact system | Balasore model |

Level of Integration | • There is a downloadable API • Need merchant id and the total amount to start up a transaction. | • Enables account hold- ers to pay for goods and services from par- ticipating merchants | • Integrate with E-travel agency. |

Anonymity | • eliminating continuous use of buyer ’s sensitive information • The issuer provides the credit | • Subscribers need extra card • No central Informa- | • The credit card number is the only buyer ’s in- formation used in a |

IJSER © 2013 http://www.ijser.org

International Journal of Scientific & Engineering Research Volume 4, Issue 1, January-2013 8

ISSN 2229-5518

| card no third part | tion storage. | purchase, and it is stored at the buyer ’s bank. |

Traceability | • The issuer and the UEPS have an unforgettable proof of transac- tion. | • A profile is created for the Cardholder • Web Access identifies the Cardholder • Transactions can be traced from start to finish. | • The payment gateway is used to trace transac- tions. • The receipt number is also used to trace pur- chases. |

Mobility | • Web access only | • Mobile phone and in- ternet accessibility | • Online web access |

Security | • Uses the TSL/SSL protocol. • The consumer and each vendor generate a public key and a se- cret key. The public key is sent to the EPS. The secret key is re- encrypted with a password. • There is offline authentication of an SMS. | • Uses SSL encryption and other banks secu- rity systems. | • Use the merchant’s pri- vate and public key and the Payment gateway’s public and private key to encrypt and decrypt. • It also uses insecure private network for communication be- tween the merchant and the payment gateway. |

Portability | • Accessible online using Web | • Accessible on WAP and Web. | • Accessible online using Web |

Atomicity | • Based on the availability of UPS and high bandwidth , not yet tested on WAN environment, is light weight | • Installed UPS, high bandwidth network connectivity. | • The system is Light weight. |

IJSER © 2013 http://www.ijser.org